The Context. The last 25 years of Africa’s connectivity has been driven mainly by two industry forces (1) Internet Service Providers (ISPs) and (2) Mobile Network Operators (MNOs). ISPs have driven enterprise on one side while MNOs have driven consumers. The biggest challenge for both these providers for digital growth has been capillary Optic Fibre and Electromagnetic Frequency Spectrum. Without Spectrum and or capillary Fibre, the price of access networks remained very expensive. In the recent past Africa is well endowed with ocean submarine cable systems; however, as you go to both big and small towns, the network is thinner. We call it the funnel.

There is an emerging paradigm as the world is embracing Edge Cloud on one side and 5G Private Networks on the other. African regulators must look at these emerging business models as a way to address Africa’s digital future. Almost all countries are now rolling out 5G Private Networks except those on the African continent. It is important to note that there is a role for both public 5G Networks and private 5G Networks. Drivers for 5G Private Networks are available in Africa, providing ample reasons and opportunities for business

Most importantly, Africa has coastlines with logistic hubs in the form of Seaports and Airports. Africa is also endowed with natural resource mines, Oil and Gas drilling facilities that are all possible Private 5G use cases. Africa has its share of Manufacturing capacity and consumer-facing retail Shopping Malls. All will need Private 5G Networks as they connect the Internet of Things (IoT) and Edge Cloud.

The success of machine to machine and or IoT connectivity will primarily rely on Private 5G Networks. 5G Architecture and business models are different from 2G, 3G and 4G for the NMOs, MVNEs and MVNOs. The new model(s) of 5G presents an opportunity to design the network or platform in a way that is sliceable. Network Slicing is the driver of the new architecture. Also, the new 5G environment has access to crucial electromagnetic frequency spectrum in the mm-Wave range of 24 to 28Ghz and above. This is called Stand-Alone or New Radio (NR) and has excellent characteristics never seen in previous generations.

The question that many people ask is whether spectrum is available to accommodate both Private 5G Network and Public 5G Networks. The answer is YES, and the ITU will continue to make spectrum available in the mm-Wave, Sub 6Ghz and Below 1 GHz ranges. It must be noted that even before WRC-15 studies were done to allow more spectrum to be available and in WRC-19, the ITU-R made resolutions for more spectrum to be available for IMT 2020 and beyond. The resolution below is an excellent example of the additional spectrum that is to be studied by countries and or governments with recommendations made to the WRC-23 that is three years away.

Resolution 245 (WRC-19)[1]

“to conduct and complete in time for WRC-23 the sharing and compatibility studies1, with a view to ensuring the protection of services to which the frequency band is allocated on a primary basis, without imposing additional regulatory or technical constraints on those services, and also, as appropriate, on services in adjacent bands, for the frequency bands: — 3 600–3 800 MHz and 3 300–3 400 MHz (Region 2); — 3 300–3 400 MHz (amend footnote in Region 1); — 7 025–7 125 MHz (globally); — 6 425–7 025 MHz (Region 1); — 10 000–10 500 MHz (Region 2), resolves 1 to invite CPM23–1 to define the date by which technical and operational characteristics needed for sharing and compatibility studies are to be available, to ensure that studies referred to in resolves to invite ITU-R can be completed in time for consideration at WRC-23; 2 to invite WRC-23 to consider, based on the results of the above studies, additional spectrum allocations to the mobile service on a primary basis and to consider identification of frequency bands for the terrestrial component of IMT; the frequency bands to be considered being limited to part or all of the bands listed in resolves to invite ITU-R 2,

Invite Administrations to participate actively in these studies by submitting contributions to ITU-R.”

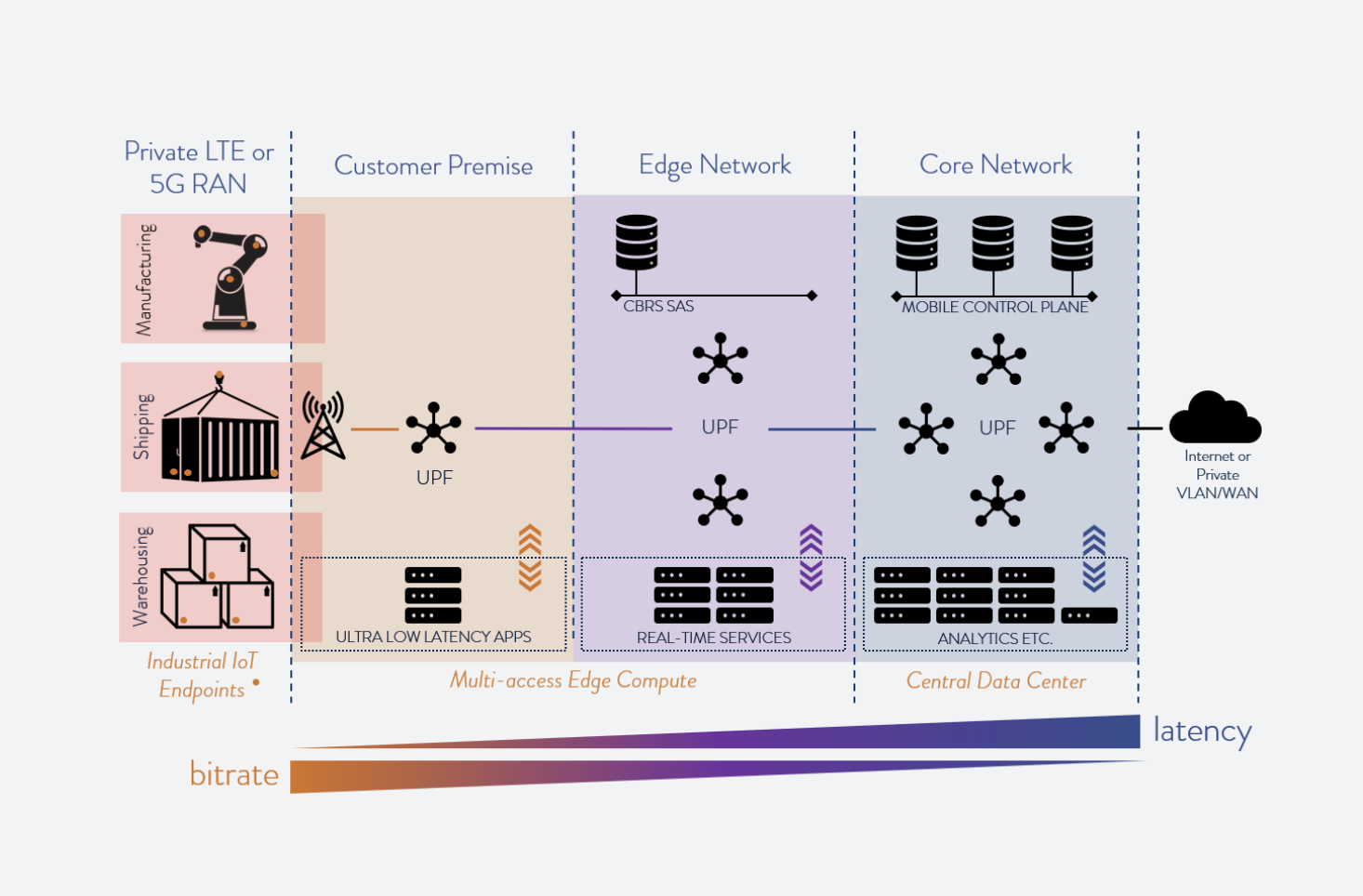

Private 5G Network Architecture explained

The concept of Private 5G is the ability for an organization or an industry to deploy its Mobile Radio access network for specific applications rather than relying on traditional public MNO’s networks.

Private 5G network allows industries and organizations to architect the network depending on the application it would be used for rather than just creating a framework for Mobile Broadband which MNO’s typically do. This is facilitated by the fact that 5G has introduced the concept of network slicing, where the same network can be split depending on the applications being run on the network such as IoT, Low Latency Applications, Vehicular Mobility or Robotics.

Multiple industries are now in advanced stages of deploying massive IoT, Robotics, AI and other advanced control system technologies. The advent of the cloud means industries are now looking at how to leverage the flexibility of the cloud with the On-premise deployments of next-generation technologies. Private 5G implementations are the most cost-effective way to build and scale a network with different SLA requirements rapidly. The Private 5G deployments will also allow employees to access the internet, from places that would have been a challenge for traditional mobile networks like Oil Rigs, Mining, Luxury cruises and more.

The Private 5G Network architecture consists of the following components

The Private 5G Network architecture

Ref: www.metaswitch.com/private5G[2]

1. 5G spectrum:

First and foremost, to begin rolling out a Private 5G network, there is a requirement to have 5G compatible spectrum either in the sub 6Ghz (3.4 GHz to 3.8Ghz ) or in the mmWave spectrum (26 to 28 GHz ). Countries like Germany already have the regulatory framework in place to allow industries to bid for localized spectrum at a lesser cost compared to either regional or national allotment. Other MNO’s like Verizon have Private 5G as an offering, where they provide the complete Private 5G deployment utilizing their national spectrum.

2. 5G Radio

5G radio is the most crucial component of Private 5G. The 5G radio is referred to in 5G terms as gNB (The new base station or new radio). There are two types of 5G radio:

– Integrated Radio:- Where the Control Unit and Data Unit of the radio is inbuilt along with the MIMO antenna. Nokia, Samsung, Ericsson are few of the players who are deploying Integrated Radio.

– Disaggregated Radio:- Where the control and data unit are implemented as a software stack, which works with a MIMO antenna with the software form factor of DU or CU implemented in an Edge Cloud or a Central Cloud. Newer vendors such as Mavenier, Radiysis, AirSpan, Altiostar are the ones focused on building disaggregated radio.

In a smaller setup such as Private 5G network, Disaggregated Radio’s enable operators to roll out base stations at a rapid manner with lower cost compared to Integrated Radio which is much more expensive.

3. Midhaul & Backhaul

The radio needs a connection back to either an Edge Cloud hosting the DU or a Central Cloud which will host the subscriber Database in the cloud or On-Premise cloud. While in traditional 5G networks, a wireless backhaul may be more applicable, for Private-5G networks fibre is a more preferred approach because of the line of sight requirements between the fronthaul and backhaul.

In an Integrated Radio, the radio acts as both fronthaul and midhaul, in disaggregated radio, the Communication between Radio and Data Unit is considered as a midhaul and from Data Unit to Centralized Cloud is called as backhaul.

4. 5G Packet Core

5G Packet Core can be characterized as the brain of the 5G network. 5G Packet core consists of various functionalities that help in the slicing of the network and in managing and authenticating the subscribers.

The 5G packet core consists of the following:

a. AUFS and UDM: Authentication server and Subscriber management

b. PCF: Policy control Function

c. Access and Mobility Management to enable subscribers to move from different base stations

d. SMF:- Session Management Functions

e. UPF:- User Plane functions

Typically, the Packet Core in previous generations have been primarily built by OEM’s and were expensive to deploy and manage. In 5G all the Packet core functionalities are distributed utilizing microservices and also implemented either as Virtual machines or containers with the ability to deploy cost-effective micro or Small 5G Packet Core for industrial use-cases. 5G packet core can be deployed on COTS hardware to enable scale and reduce cost.

5. Edge and Central Cloud

Edge and Central cloud play a vital role in Private 5G deployments as they host disaggregated Radio controllers, data units and the Packet core. In addition, Private 5G applications need to be hosted in a scalable cloud for Robotics, AI, IoT etc.

The two deployment industry standards for 5G edge and Central Cloud are:

a) Kubernetes

b) OpenStack

Typically edge Cloud and Kubernetes would play a larger role as most of the 5G disaggregated radio units are now available to be run as containers. In addition, there are various micro deployments of Kubernetes distribution available to deploy and scale Kubernetes for stateless applications quickly. MicroK8s from Canonical is one such distribution. There is also a beta version of micro OpenStack called MicroStack that can be utilized for edge deployments where the radio controllers are available as virtual machines.

Openstack is fundamentally targeted for the deployment of Central Cloud, where the scale of packet core and other control unit functions are deployed. Both Kubernetes and OpenStack are OpenSource, thereby enabling a lower cost/unit for Private 5G deployment than relying on traditional Vendors.

6. Network Slicing

Network slicing is an essential requirement for a successful Private 5G deployment because of the value add for users. The advantage of 5G standards is that it allows Private 5G networks to split their network based on various network characteristics such as latency, Bandwidth, Loss, packet size etc.

This splitting enables private 5G networks to create various network packages to apply to different applications such as office Broadband, industry IoT/Robotics, camera AI and more, where each package consists of different types of network qualities and SLA.

Private 5G Network Business Model

Utility companies have traditionally used private networks, railways or companies operating in remote industrial locations beyond the reach of cellular networks. Increasingly we are seeing the adoption of private networks in large campuses, buildings, hospitals, manufacturing plants, multi-dwelling units driven mainly by the unique characteristics of 5G. The 5G Private network business model addresses three areas, namely coverage, cost and operational effectiveness.

Coverage — The public MNOs in some cases do not provide the required coverage especially at the remote locations or too ample space due to considerations such as that their business model is primarily consumer-oriented and where they don’t see scale it doesn’t fit into their business model. Additionally, the bespoke requirements of private networks requirements are demanding for them.

Cost — The public MNOs billing model of pay per use for connectivity or lock-in for services that can in some instances be cost-effectively delivered via Capex rather than Opex especially given the growing use of open source and cloud resources for 5G. This enables the enterprise to own the connectivity and scale with ease to bring the unit cost further down. Industry 4.0 and smart factories require flexible and adaptable workspaces without the need to rewire the premises.

Operational Effectiveness — Private 5G networks use licensed spectrum that has better performance and less interference. This provides the enterprises with better visibility and management of critical metrics such as latency, throughput and more. Private 5G networks offer greater control of security and compliance through identity credentials localization of sensitive data, so it does not go off-site. On-premise compute and storage facilitated of 5G networks will lead to quicker and more effective use of network resources.

Private 5G Network Regulatory Model in Africa

It is expected that regulation will play a key role in shaping the rollout of 5G. Regulators need to make suitable spectrum available in the appropriate bands in sufficient amounts and with proper license conditions. Governments and Telecommunication regulators in Africa are yet to develop 5G rollout plans. South Africa recently issued an Invitation to Apply (ITA) for 5G spectrum while other major countries like Kenya have ongoing trials but have not issued any spectrum allocation bids.

Africa is part of region one within the International Telecommunications Union (ITU) regions classification together with European countries. It is critical that Africa’s regulatory strategy and framing have similarity to that of Europe so we can leverage on the resultant economies of scale for network equipment and device manufactures. If Africa is to realize the full benefits of 5G and drive innovation and competition, the Regulators need to release spectrum quickly. In addition to releasing new spectrum, regulators would need to reuse the currently allocated spectrum that 5G will use.

It is vital that the regulators in the region one release spectrum that is similar. Africa should support 5G spectrum range 2600 MHz, 3.5 GHz, 26 GHz, 28 GHz. Examples of the 5G spectrum already released or in consultation in Europe are Germany (3.7–3.8 GHz, 24.5–27.5 GHz), UK (3.8–4.2 GHz, 24.25–27.5 GHz), Finland (3.4–3.8 GHz), Netherlands (3,5 GHz).

The performance of private 5G networks will depend on the quantity and ranges of spectrum available. Mid-band spectrum (1–6 GHz) works well in indoor environments, enabling wide coverage with a relatively small number of transmission points. Millimetre-wave spectrum (24–29 GHz, 37–43.5 GHz, and 66–71 GHz) offers higher speeds and lower latency, and its signals are easier to contain within a building, thus lessening the potential for interference with other networks.

Pricing of spectrum for Private 5G would have to take into account the return on investment, financial constraints and impact on future investment. Governments and Regulators should strive to get the balance right. With most countries fiscus affected by the Covid 19, there is a likelihood of the spectrum auctions being viewed as a means to improve the fiscus and pricing them too high.

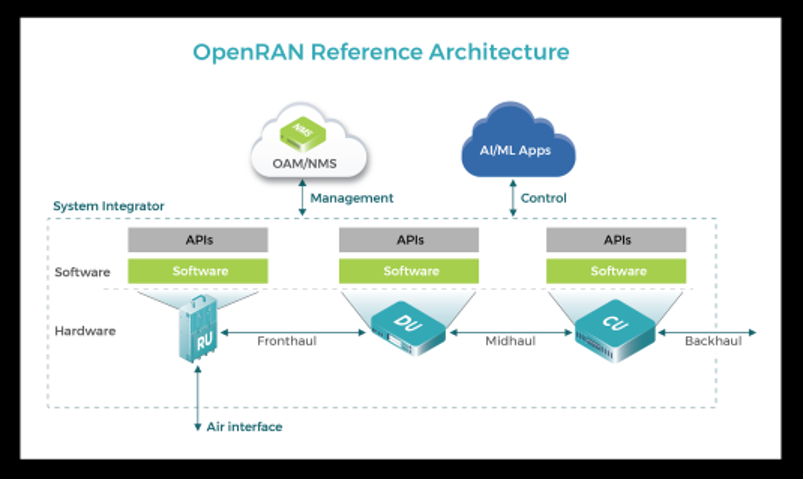

Open Radio Access Network (ORAN) and Private 5G Networks

As the industry adopts 5G, the core component of 5G is the advent of virtualization and utilizing OpenSource technologies to keep the cost of 5G networks lower compared to traditional deployment models. The direct cost of deploying any 5G network lies in the ability of a service provider or a Private 5G operator to build Radio access networks (RAN) quickly. In traditional deployments, Radio Networks were typically owned by a single vendor and would not interoperate with other vendors.

For example, a specific antenna for a vendor would only work with the vendor’s Data Unit and the vendor’s control unit. This slowed the pace of adoption as a Service provider or a Private 5G operator would have to stick to a specific vendor for a lifetime.

Hence to facilitate the adoption of true disaggregation, ORAN alliance was formed for service providers to enable OpenStandards between the various components of a Radio Access Network. The ORAN alliance was initially conceptualized by AT&T, China Mobile, Deutsche Telekom, NTT DOCOMO, and Orange in 2018. Today the ORAN alliance has more than 25 Service providers actively participating with more 150 + Software, Hardware, radio vendors now part of the alliance.

A cost-effective Private 5G requires ORAN and open standards to reduce the overall cost of deployment and scale. Even Traditional RAN vendors such as Nokia, Ericsson and Samsung have committed to ORAN.

OpenRan Reference Architecture[3]

Opportunity for SMMEs and ISPs

Several market research studies believe that enterprises and the public sector will be the initial 5G customers through private networks. For ISPs, this brings about opportunities beyond the provision of the internet through the provision of services such as SD Wan and Storage.

SD-WAN

5G will accelerate the adoption of IoT in several industries as they transform digitally. However, this integration and transformation may not be smooth for the 5G private network operators. To cope with the rapidly evolving needs of traffic and to unlock the power of IoT, businesses are increasingly leveraging software-defined wide area networks or SD-WAN. With 5G enabling applications to operate within different virtualized environments, SD-WAN prevents unauthorized access of sensitive information in two ways, through path isolation and security controls. This presents massive opportunities for any ISP, providing SD Wan services.

5G can dramatically reduce data transport times, but this benefit is lost if devices and applications don’t have the computing performance to process high volumes of data quickly. SD-WAN allows organizations to move computing functions to the cloud, where resources are more scalable and can be located closer to edge devices

Storage

5G will generate data at an unprecedented velocity and volume and fuel a wide range of data-driven services and digital business models. The demand for high volume, real-time processing, can only be met by processing on the edge. Real-time 5G IoT applications will require systems sitting on the edge, processing data and connected to backend repositories. This requires two types of storage systems, one for the edge and one for the backend repository. On the edge, the storage system will need to be a low-cost, high-performance storage system that can manage very high volumes of data. The ISP can provide this storage.

Security, Data Compute and Storage will rise with 5G networks presenting massive opportunities for ISPs.

Innovation and flexibility are critical drivers for the solutions that will underpin the development of 5G, and globally we are seeing trends where Venture Capitalists and major telecom companies are backing and funding SME to develop 5G dependent solutions. SME and startups often have the flexibility and speed of action to execute, and these are characteristics required in new and disruptive technology such as 5G. The regulatory framework that supports the growth of startup and SME is the one that will succeed the most in realizing the benefits of 5G.

Conclusion

The world we are going into will have two types of 5G, a public 5G offering which is for the consumer market primarily offering enhanced mobile broadband and private 5G offering targeting enterprises. However, there can be a shared open network to be used for both Enhanced mobile broadband (consumer-oriented) and ultra-reliable low latency connection, massive machine type communication (enterprise). This coexistence has to be allowed at a regulatory level; in the same way, there was coexistence between ISP and fixed service providers. Public networks focusing on consumers and Private networks focusing on enterprises should have a relationship to allow for full access to services.

An example of service providers understanding and focusing on their target markets is seen in the Data Centre space. Telcos believed they would be significant providers of Data centres as they already had massive connectivity to customers, however as we know today the major Data Centre providers are the likes of AWS, Google, Microsoft Azure. There are many reasons for this: the main one being a typical Telco model is designed to scale by offering standard products and solutions. This doesn’t always work for some customers like Banks, security, airlines etc. who want to integrate services into their business models with great flexibility fully.

A service provider that doesn’t allow them that flexibility does not suit their model, and we believe we will see the same happening in the 5G area hence our forecast that the public 5G offering by MNOs will be for consumer-type service of enhanced mobile broadband and the private 5G model will be by Cloud and Digital service providers targeting enterprises

Glossary

5G — Fifth Generation of mobile communications

ITU — International Telecommunications Union

WRC — World Radio Conference

DU — Distribution Unit

References:

[1] https://www.itu.int/en/ITU-R/conferences/wrc/2019/Pages/default.aspx

[2] metaswitch.com

[3] https://telecominfraproject.com/wp-content/uploads/OpenRAN-Reference-Architecture.png

inq. is a Pan-African digital services provider with points of contact in 13 different cities.

Visit www.inq.inc for more information